“California Powerhouse Law Firm 2023”

– Law360

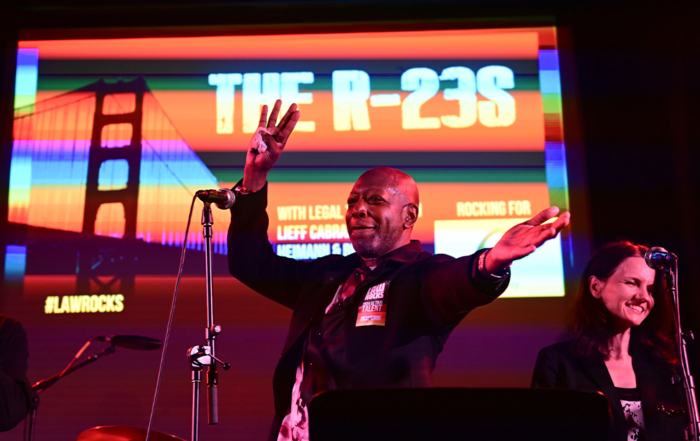

Lieff Cabraser is committed to achieving justice for our litigation clients through class actions and individual lawsuits. Since 1972, we have helped recover over $129 billion in verdicts and settlements for our clients worldwide.

Extraordinary Recognition

Practice Areas

Contact us today

- Your data and privacy are secure;

- No received data is shared;

- US/EU privacy compliance.

News, Blog & Updates

0

Lawyers in four offices

0 billion

Recovered for our clients

0

Practice Areas